Introduction?

Seller financing, also known as owner financing or vendor take-back, is an alternative method of property sale where the seller acts as the lender, providing a loan to the buyer for the purchase of their property. Instead of the buyer obtaining a mortgage from a traditional financial institution, they make payments directly to the seller over an agreed-upon period. When you need to “Sell My House Fast in Richmond, VA“, RVA Home Buyers has over 25 years of local market expertise to help you overcome these challenges.

In a seller financing arrangement, the property’s ownership is transferred to the buyer at the time of sale, but the seller retains a lien on the property until the loan is fully paid off. This setup allows the seller to receive a steady stream of income through monthly payments, which typically include both principal and interest.

The parties involved in a seller financing deal are:

- The seller (also acting as the lender)

- The buyer (also known as the borrower)

- A title company or attorney (to handle the legal aspects of the transaction)

Compared to traditional financing, seller financing offers several unique features:

- Flexibility: Terms can be negotiated directly between the buyer and seller, allowing for customized arrangements that suit both parties.

- Faster closing: Without the need for bank approvals, the process can be quicker than conventional mortgages.

- Potential for higher returns: Sellers can often charge higher interest rates than they would earn from other investments.

- Accessibility: Buyers who might not qualify for traditional mortgages can still purchase property.

However, it’s important to note that seller financing also carries risks, particularly for the seller, who must be prepared to handle potential default scenarios and comply with relevant lending laws. Make sure you fully up to speed before moving forward with selling by reading the following related posts: 5 Things You Need to Know About Selling Your Richmond House With Owner Financing, Owner Financing Can Help You Achieve Your Asking Price, Can Help You Sell Your House Faster, Can Provide Tax Benefits, and Direct Sale Can Help Sell Your House.

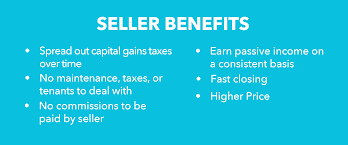

Benefits of Offering Seller Financing

Seller financing can be a powerful tool for property owners looking to sell their real estate while potentially earning a steady monthly income. This alternative financing method offers several compelling advantages:

- Monthly Income Stream: Perhaps the most attractive benefit of seller financing is the opportunity to create a reliable monthly income. Instead of receiving a lump sum payment, you’ll receive regular installments over an agreed-upon period. This can provide financial stability and supplement your existing income sources.

- Potential for Higher Sale Price: When offering seller financing, you may be able to command a higher sale price for your property. Buyers are often willing to pay a premium for the convenience and flexibility of seller financing, especially if they have difficulty obtaining traditional mortgage loans.

- Tax Advantages: Seller financing can offer significant tax benefits. By spreading the income from the sale over several years, you may be able to defer capital gains taxes and potentially reduce your overall tax liability. This strategy can be particularly beneficial for high-income sellers looking to optimize their tax situation.

- Faster Sales Process: Properties offered with seller financing often sell more quickly than those requiring traditional financing. This is because the pool of potential buyers expands to include those who may not qualify for conventional mortgages. The streamlined process can also lead to faster closings, as there’s no need to wait for bank approvals or deal with extensive paperwork.

- Attractive Investment Opportunity: Seller financing allows you to earn interest on the loan, potentially at a higher rate than you would receive from other investment vehicles. This can make your property sale a lucrative investment opportunity, especially in a low-interest-rate environment.

- Control Over Terms: As the financier, you have the flexibility to set the terms of the loan, including interest rates, repayment period, and any balloon payments. This level of control can be advantageous in tailoring the agreement to suit your financial goals.

- Expanded Buyer Pool: By offering seller financing, you open up your property to a wider range of potential buyers, including self-employed individuals, those with non-traditional income sources, or buyers with less-than-perfect credit scores.

- Potential for Passive Income: Once the financing agreement is in place, the monthly payments you receive can become a form of passive income, requiring minimal ongoing effort on your part.

By leveraging these benefits, seller financing can transform a property sale into a strategic financial move that provides ongoing returns and flexibility for both the seller and the buyer.

Types of Seller Financing Arrangements

Seller financing comes in various forms, each tailored to specific situations and preferences of both the seller and buyer. Understanding these different arrangements can help you choose the best option for your circumstances and maximize your potential monthly income.

Land Contracts

Land contracts, also known as contracts for deed, are a popular form of seller financing, especially for real estate transactions. In this arrangement, the seller retains the legal title to the property while the buyer makes regular payments. The buyer gains equitable title and the right to use the property. Once all payments are made, the legal title transfers to the buyer. This option provides flexibility and can be attractive to buyers who may not qualify for traditional mortgages.

Lease Options

Lease options combine elements of renting and buying. The buyer (tenant) pays rent to the seller (landlord) for a specified period, with part of the rent going towards the purchase price. The tenant has the option to buy the property at the end of the lease term at a predetermined price. This arrangement can be beneficial for buyers who need time to improve their credit or save for a down payment, while sellers earn monthly income and potentially sell their property at a higher price.

Owner Financing

In a straightforward owner financing deal, the seller acts as the bank. The buyer makes regular payments directly to the seller, including principal and interest. The seller retains the title until the loan is paid in full. This method offers great flexibility in terms of interest rates, repayment schedules, and other terms, allowing both parties to create a mutually beneficial agreement.

Wraparound Mortgages

A wraparound mortgage is a more complex form of seller financing. In this scenario, the seller’s existing mortgage remains in place, and a new loan is created that “wraps around” the original mortgage. The buyer makes payments to the seller, who then uses a portion of those funds to continue paying the underlying mortgage. This can be an effective strategy when the seller’s existing mortgage has favorable terms that they want to maintain.

Each of these seller financing arrangements offers unique advantages and considerations. By understanding the nuances of each type, you can select the most appropriate method to generate monthly income while meeting the needs of potential buyers.

How to Structure a Seller Financing Deal

Structuring a seller financing deal requires careful consideration of several key elements to ensure a mutually beneficial arrangement for both the seller and the buyer. Here’s how to approach each crucial component:

Determining Interest Rates

When setting the interest rate, consider the current market rates, the buyer’s creditworthiness, and your desired return on investment. Typically, seller-financed loans carry higher interest rates than traditional mortgages, often ranging from 1-3 percentage points above market rates. This higher rate compensates for the increased risk and provides a better return for the seller.

Down Payment Requirements

A substantial down payment reduces risk for the seller and demonstrates the buyer’s commitment. While traditional mortgages might require 20% down, seller financing arrangements often ask for 10-30% of the purchase price. The exact amount can be negotiated based on the buyer’s financial situation and your comfort level with risk.

Repayment Terms

Decide on the loan duration, which can range from a few years to 30 years. Shorter terms mean faster repayment but higher monthly payments for the buyer. Consider offering an amortization schedule that outlines how the loan balance decreases over time with each payment.

Balloon Payments

Including a balloon payment can be advantageous for sellers who don’t want to finance the property long-term. This large, lump-sum payment is due at the end of a shorter loan term, typically 5-10 years. It allows for lower monthly payments during the loan term but requires the buyer to refinance or pay off the remaining balance when the balloon comes due.

When structuring these elements, it’s crucial to balance your financial goals with terms that are attractive and feasible for potential buyers. Remember, the more flexible and reasonable your terms, the more likely you are to attract qualified buyers and successfully close the deal. Always consult with a real estate attorney or financial advisor to ensure your seller financing structure complies with local laws and protects your interests.

Legal Considerations and Documentation

When offering seller financing, it’s crucial to understand and address the legal aspects to protect your interests and ensure compliance with relevant laws. Proper documentation is essential for creating a legally binding agreement and safeguarding your investment.

Promissory Notes

A promissory note is a fundamental document in seller financing. This legal instrument outlines the terms of the loan, including:

- The principal amount

- Interest rate

- Payment schedule

- Consequences of default

Ensure that the promissory note is detailed and clearly written to avoid any ambiguity or potential disputes in the future.

Mortgage or Deed of Trust

Depending on your state, you’ll need to secure the loan with either a mortgage or a deed of trust. These documents give you a legal claim on the property if the buyer defaults on payments. Key elements include:

- Property description

- Loan terms

- Rights and obligations of both parties

- Foreclosure process in case of default

State Laws

Seller financing laws can vary significantly from state to state. Some key areas to consider include:

- Usury laws that cap interest rates

- Licensing requirements for seller financing

- Disclosure obligations

- Foreclosure procedures

Consult with a local real estate attorney to ensure compliance with your state’s specific regulations.

Dodd-Frank Act Compliance

The Dodd-Frank Wall Street Reform and Consumer Protection Act has implications for seller financing, particularly for non-exempt transactions. Key compliance areas include:

- Ability-to-repay (ATR) assessment

- Qualified Mortgage (QM) standards

- Loan originator licensing requirements

- Balloon payment restrictions

For most individual sellers, there are exemptions from these requirements, but it’s essential to verify your status and comply if necessary.

Additional Documentation

Other important documents may include:

- Purchase and sale agreement

- Escrow instructions

- Title insurance policy

- Property disclosures

By carefully addressing these legal considerations and ensuring proper documentation, you can create a solid foundation for your seller financing arrangement, minimizing risks and maximizing the potential for a steady monthly income stream.

Assessing Buyer Creditworthiness

When offering seller financing, it’s crucial to thoroughly assess the buyer’s creditworthiness to minimize risk and ensure a successful transaction. This process involves several key steps and considerations:

Credit Checks

Conducting a comprehensive credit check is the first step in evaluating a potential buyer. Request their credit reports from major credit bureaus and analyze their credit scores. Look for:

- Payment history and patterns

- Outstanding debts and credit utilization

- Length of credit history

- Recent credit inquiries

- Bankruptcies, foreclosures, or other negative marks

A buyer with a strong credit history is more likely to make timely payments on your seller-financed deal.

Income Verification

Verifying the buyer’s income is essential to ensure they can afford the monthly payments. Request:

- Recent pay stubs

- Tax returns for the past 2-3 years

- W-2 forms or 1099s

- Bank statements

For self-employed buyers, ask for profit and loss statements and business tax returns. Calculate their debt-to-income ratio to determine if they can comfortably manage the payments alongside their other financial obligations.

Down Payment Ability

A substantial down payment demonstrates the buyer’s financial commitment and reduces your risk. Consider:

- Requiring a minimum down payment (typically 10-20% of the purchase price)

- Verifying the source of the down payment funds

- Assessing the buyer’s savings and liquid assets

A larger down payment can indicate a more financially stable buyer and provide you with a cushion in case of default.

Alternative Credit Scoring

For buyers with limited traditional credit history, consider alternative credit scoring methods:

- Rental payment history

- Utility bill payment records

- Cell phone bill payments

- Insurance premium payments

- Personal references

These non-traditional credit indicators can provide insights into a buyer’s financial responsibility and payment habits.

By thoroughly assessing a buyer’s creditworthiness through these methods, you can make an informed decision about whether to offer seller financing. This careful evaluation process helps protect your investment and increases the likelihood of receiving consistent monthly income from the arrangement.

Calculating Potential Monthly Income

When offering seller financing, understanding how to calculate your potential monthly income is crucial for making informed decisions and ensuring a profitable arrangement. This income typically comes from two main components: interest income and principal payments.

Interest income is the profit you earn from lending money to the buyer. It’s calculated as a percentage of the outstanding loan balance and represents the cost of borrowing for the buyer. The interest rate you set should be competitive with current market rates while also reflecting the risk you’re taking on as a private lender.

Principal payments, on the other hand, are the portions of each monthly payment that go towards reducing the original loan amount. As the buyer makes these payments, your outstanding loan balance decreases, but so does your interest income over time.

To accurately project your monthly income, you’ll need to create an amortization schedule. This detailed table shows how each payment is split between interest and principal over the life of the loan. In the early years of the loan, a larger portion of each payment goes towards interest, gradually shifting towards more principal as time goes on.

Here’s a simplified example of how an amortization schedule might look for a $200,000 loan at 6% interest over 30 years:

- Month 1: Payment $1,199.10 (Interest: $1,000.00, Principal: $199.10)

- Month 2: Payment $1,199.10 (Interest: $999.00, Principal: $200.10)

- …

- Month 360: Payment $1,199.10 (Interest: $5.98, Principal: $1,193.12)

Using this amortization schedule, you can create cash flow projections to estimate your monthly income over the life of the loan. Remember that your actual income may fluctuate based on factors such as early payoffs, late payments, or defaults.

To maximize your monthly income, consider strategies like:

- Offering shorter loan terms to increase monthly payments

- Charging a higher interest rate (within legal limits) to boost interest income

- Requiring a larger down payment to reduce risk and increase your immediate cash flow

By carefully calculating and projecting your potential monthly income from seller financing, you can make strategic decisions that balance profitability with buyer affordability and market competitiveness.

Risks and Mitigation Strategies

Offering seller financing can be a lucrative venture, but it’s not without its risks. Understanding these potential pitfalls and implementing effective mitigation strategies is crucial for protecting your investment and ensuring a steady monthly income.

Default Risk

The most significant risk in seller financing is the possibility of buyer default. If the buyer stops making payments, you may face a lengthy and costly foreclosure process. To mitigate this risk:

- Thoroughly vet potential buyers, including comprehensive credit checks and income verification.

- Require a substantial down payment (typically 20% or more) to ensure the buyer has a vested interest in the property.

- Include clear default clauses in the contract, outlining the consequences and your rights as the seller.

- Consider setting up an escrow account for property taxes and insurance to ensure these crucial payments are made.

Property Depreciation

If the property value decreases significantly, the buyer may be tempted to walk away from the deal, leaving you with a depreciated asset. To protect against this:

- Conduct a thorough property appraisal before agreeing to seller financing.

- Include provisions in the contract that require the buyer to maintain the property to certain standards.

- Consider including a “due-on-sale” clause that allows you to call the loan due if the property is sold or transferred.

Legal Disputes

Misunderstandings or breaches of contract can lead to costly legal battles. Minimize this risk by:

- Having a real estate attorney draft or review all contracts and agreements.

- Clearly outlining all terms, conditions, and expectations in the contract.

- Including a mediation or arbitration clause to resolve disputes without going to court.

- Keeping detailed records of all transactions and communications with the buyer.

Insurance Requirements

Inadequate insurance coverage can leave you exposed to significant financial loss. Protect your investment by:

- Requiring the buyer to maintain comprehensive property insurance and provide proof of coverage annually.

- Including yourself as an additional insured party on the policy.

- Considering mortgage protection insurance to cover payments in case of the buyer’s death or disability.

By understanding these risks and implementing robust mitigation strategies, you can significantly increase your chances of success in seller financing. Remember, while the potential for earning a monthly income is attractive, protecting your investment should always be your primary concern.

Tax Implications of Seller Financing

Seller financing can have significant tax implications that need to be carefully considered before entering into such an arrangement. Understanding these tax consequences is crucial for both sellers and buyers to make informed decisions and properly report their income.

Installment Sale Treatment

When you offer seller financing, the IRS typically treats the transaction as an installment sale. This means you report the gain on the sale over time as you receive payments, rather than all at once in the year of the sale. This can be advantageous as it allows you to spread out your tax liability over several years, potentially keeping you in a lower tax bracket.

The installment method requires you to calculate the gross profit percentage on the sale. This is done by dividing the gross profit by the contract price. Each payment you receive will consist of three components: return of your basis, capital gain, and interest income.

Capital Gains Considerations

The profit you make on the sale of property is typically subject to capital gains tax. The rate you’ll pay depends on how long you’ve owned the property and your overall income level. If you’ve owned the property for more than a year, you’ll benefit from long-term capital gains rates, which are generally lower than ordinary income tax rates.

It’s important to note that even though you’re receiving payments over time, you may still owe some capital gains tax in the year of the sale if you receive any payments in that year. This is known as the “year of sale” installment, and it’s treated differently than subsequent years’ payments.

Interest Income Reporting

The interest portion of each payment you receive is considered ordinary income and must be reported as such on your tax return. This interest is taxed at your regular income tax rate, which is typically higher than the capital gains rate.

You’ll need to provide the buyer with a Form 1098 each year, showing the amount of interest they’ve paid. This allows them to potentially deduct the interest on their tax return if the property is used as their primary residence.

Recapture of Depreciation

If you’re selling a rental property or other investment property on which you’ve claimed depreciation, you may be subject to depreciation recapture. This means that a portion of your gain, equal to the amount of depreciation you’ve claimed, will be taxed as ordinary income rather than at the more favorable capital gains rate.

Alternative Minimum Tax (AMT) Considerations

In some cases, reporting income from an installment sale can trigger the Alternative Minimum Tax (AMT). This is a separate tax calculation designed to ensure that taxpayers with significant deductions and credits pay at least a minimum amount of tax. It’s important to consider the potential impact of AMT when deciding whether to offer seller financing.

Understanding these tax implications is crucial when considering seller financing. It’s always advisable to consult with a tax professional or financial advisor to fully understand how seller financing will affect your specific tax situation and to ensure you’re complying with all relevant tax laws and regulations.

When to Consider Offering Seller Financing

Seller financing can be a powerful tool in real estate transactions, but it’s not always the best option. Understanding when to consider offering seller financing can help you maximize your returns and minimize risks. Here are some key factors to consider:

Market Conditions

In a buyer’s market where traditional financing is difficult to obtain, seller financing can make your property more attractive. This is particularly true during economic downturns or when banks tighten their lending criteria. By offering financing, you can potentially sell your property faster and at a better price than competitors relying on conventional loans.

Property Types

Certain property types are more suited to seller financing. For example:

- Commercial properties that may not qualify for traditional bank loans

- Unique or unconventional homes that appraisers struggle to value

- Properties in need of significant repairs or renovations

- Land or undeveloped lots, which often face stricter lending requirements

Buyer Demographics

Seller financing can be appealing to specific buyer groups:

- Self-employed individuals or those with non-traditional income sources

- Buyers with a less-than-perfect credit history

- Investors looking for creative financing options

- First-time homebuyers struggling to secure conventional mortgages

Personal Financial Goals

Your own financial situation and goals play a crucial role in deciding whether to offer seller financing:

- If you’re looking for a steady stream of monthly income, seller financing can provide this through regular payments

- If you want to defer capital gains taxes, seller financing allows you to spread the gain over several years

- If you’re retiring and want to convert a property into an income-producing asset, seller financing can be an attractive option

Market Interest Rates

When market interest rates are low, offering seller financing at a higher rate can provide better returns than other investment options. Conversely, in a high-interest-rate environment, seller financing might be less attractive unless you can offer competitive rates.

Property Marketability

If your property has been on the market for an extended period without attracting buyers, offering seller financing can expand your pool of potential purchasers and increase the likelihood of a sale.

By carefully considering these factors, you can determine whether offering seller financing aligns with your property, the current market conditions, and your personal financial objectives. When used strategically, seller financing can be a win-win situation for both you and the buyer. As specialists in the Richmond area real estate market, we’re positioned to assist you immediately – as a leading “We Buy Houses in Richmond, VA” company.