Introduction

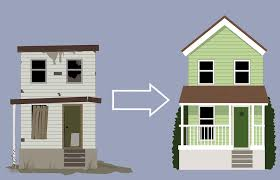

Fix-and-flip real estate investing involves purchasing distressed or undervalued properties, renovating them, and then reselling for a profit. It can be a lucrative way to grow your wealth if done right. Richmond has emerged as one of the hottest markets for fix-and-flips due to its strong fundamentals.

The city has a robust economy and job market, affordable housing prices compared to other metro areas, and a vibrant culture that is attracting new residents. Meanwhile, the inventory of old, run-down homes is plentiful. With the right rehab, these properties can be transformed into modern, move-in-ready homes for today’s buyers.

The key to success is buying low, improving the property cosmetically and adding square footage if possible, and then selling high. With the right financing, contractor relationships, and exit strategy, you can maximize your profit potential on fix-and-flips in Richmond. It offers an ideal combo of low buy-in costs and strong resale demand. Also, to further your education, make sure you read Low-Risk Ways to Invest in Richmond Real Estate, including Invest in Rental Properties, Invest in Vacation Rentals, Invest in Commercial Properties, and Invest in Real Estate Investment Trusts (REITs).

Richmond Real Estate Market

The Richmond real estate market has seen steady growth over the past decade, making it an attractive location for investing in fix-and-flip properties. Home prices in Richmond have increased around 30% since 2012, lower than the national average but showing a healthy upward trend. The median home price as of 2022 reached $350,000.

The city’s economy and job market are thriving, which supports the real estate demand. Major employers like Capital One, Genworth Financial, Altria Group, and Amazon have operations in Richmond, providing tens of thousands of jobs. The city’s unemployment rate is very low at around 3%. Population growth is also driving real estate, with nearly 15,000 new residents moving to Richmond from 2018 to 2020.

With rising home values and strong economic fundamentals, Richmond offers promising conditions for fix-and-flip investors to turn profits. The market has high demand from both owner-occupants and investors, ensuring there are buyers interested in renovated homes. The relatively affordable housing prices also allow room for appreciation once repairs are made. Focusing on neighborhoods popular with first-time homebuyers can be a smart approach.

Identifying Fixer-Upper Properties

Finding a good property to fix and flip requires knowing what to look for. Here are some tips for spotting a promising fixer-upper in the Richmond real estate market:

- Focus your search on older homes built from the 1950s to 1980s. These tend to need more repairs and updates which allows for a higher profit margin when flipping. Drive around target neighborhoods and look for signs of neglect like peeling paint, overgrown landscaping, or roofs in need of repair.

- Work with real estate agents who specialize in fix and flips. They will know the Richmond market well and can identify off-market deals before they hit the MLS. Ask them to notify you when a new fixer listing comes available. Drive the agent around to look at potential properties.

- Look for homes priced below market value. Check Zillow or Redfin to estimate the ARV (after repair value) based on recently sold comparable homes. Aim for homes priced at least 25% under the ARV to allow room for repairs and profit.

- Inspect the big ticket items first like roof, foundation, electrical, and plumbing systems. Repairs here can make or break the flip profitability. Also check for mold, water damage, HVAC issues.

- Cosmetic updates like kitchens, bathrooms, and flooring offer the best ROI. Look for properties needing mostly cosmetic refreshes which are cheaper to fix.

- Run the numbers with your agent to estimate costs for repairs and expected profit. Make sure the deal pencils out before moving forward.

With the right real estate agent relationships and a keen eye for properties with potential, investors can find promising fix and flip opportunities in Richmond.

Estimating Repair Costs

Estimating repair costs is one of the most critical parts of a successful fix and flip. You need an accurate estimate in order to determine the potential profitability of a property. There are a few key steps to estimating costs:

Inspecting the Property

Walk through the property and make detailed notes about issues that will need to be addressed. Pay close attention to the roof, foundation, electrical systems, plumbing, HVAC, windows, and interior finishes. Document any structural problems, water damage, or other major repairs needed. Cosmetic updates like flooring, paint, and appliances are usually cheaper fixes.

Getting Contractor Estimates

Once you’ve inspected the property, contact local general contractors to get repair estimates. Provide details on all the fixes needed. Get quotes from at least 3 contractors for comparison. Make sure the estimates align with your own assessment. If costs are higher than expected, you may need to reconsider the deal or negotiate a lower purchase price.

Common Rehab Costs

Here are some typical costs for common fix and flip repairs:

- New roof: $5,000 – $15,000

- New HVAC system: $4,000 – $12,000

- New kitchen: $10,000 – $30,000

- Bathroom remodel: $6,000 – $15,000

- New flooring: $3,000 – $8,000

- Painting: $2,000 – $5,000

- Landscaping: $2,000 – $5,000

- Electrical/plumbing repairs: $3,000 – $8,000

- Cosmetic updates: $5,000 – $15,000

Carefully estimating all repair costs is crucial for success in fix and flip investing. Always build in extra cushion for unexpected expenses that can arise during renovation. Conservative cost estimates help ensure you don’t overpay for a property.

Financing

Financing is a crucial component of any fix and flip project. There are several options to fund the purchase and renovation of a property in Richmond:

Loans

Traditional bank loans are difficult to obtain for fix and flip projects, as banks want to see that the property can cash flow. Hard money loans from private lenders are a better option. Hard money loans are asset-based loans secured by the property itself. Interest rates are higher than traditional loans but they can fund 70-90% of the purchase and renovation costs. The loan terms are usually 6-12 months so the property needs to be flipped quickly.

Hard Money Lending

Becoming a private hard money lender is a way to profit from fix and flips without doing the work yourself. As a hard money lender you can lend other investors money at interest rates from 10-15%. The loans are secured by the property with a loan-to-value ratio of 60-75%. The timeline on the loans is short term, 6-12 months. The upside is earning high interest over a short period. The risk is if the borrower defaults and the property value has fallen.

Partnerships

Partnering with other investors is a way to pool money and skills for fix and flips. A typical partnership structure is for one partner to provide most of the financing while the other partner manages the renovation. The profits are split based on the amount invested. Partnerships allow you to take on bigger projects. Make sure to create legal partnership agreements defining the responsibilities and profit split.

Managing the Rehab

Once you’ve purchased a fixer-upper property, the real work begins – managing the rehab process. This is one of the most important aspects of a successful fix-and-flip, so you’ll want to make sure you have a solid plan in place.

Hiring Contractors

- Vet contractors thoroughly – check reviews, ask for referrals, verify licenses. You want contractors who are reliable, skilled, and fair.

- Get 3+ bids for big projects to compare. Make sure all contractors are bidding on the same scope of work.

- Check references and look at examples of past work. You want contractors who consistently do quality work.

- Clearly communicate scope of work, timeline, requirements, etc upfront. Get everything in writing.

- Consider using a general contractor to manage subcontractors if it’s a big project.

- Don’t just go with the lowest bid – make sure they can deliver on the work.

- Put contracts in place spelling out scope, timeline, payment terms, etc.

Overseeing Timelines and Work

- Create a detailed project schedule and timeline. Assign target dates for each task.

- Get commitments from contractors on start/end dates before hiring. Build in some buffer room.

- Make sure to get necessary permits pulled in a timely manner.

- Visit the property frequently to check progress and quality of work.

- Keep contractors accountable to the timeline – follow up if falling behind.

- Approve/reject work at key milestones before next payment.

- Document any changes in scope or schedule with change orders.

- Don’t make final payment until all work is complete to your standards.

- Be reasonable but firm – you are the client so manage the project tightly.

Properly overseeing contractors and timelines ensures the rehab stays on track, is high quality, and is completed on time and on budget.

Maximizing Profit

One of the keys to a successful fix and flip is maximizing your profit when you sell the renovated property. Here are some tips for getting top dollar:

Comparable Sales

Research what similar properties in the area have sold for recently. Look at location, number of bedrooms/bathrooms, square footage, lot size, and condition. This will give you a good sense of what buyers in that market are willing to pay. Aim to be at the high end of comparables for your finished property.

Setting the Listing Price

Price the property based on your comps, as well as the amount of money you have invested in the purchase and renovation. Add up all your costs – purchase price, rehab costs, holding costs, closing costs. Then factor in your desired profit margin. Many flippers look for a 15-20% profit.

Also consider that there may be some room for negotiation. Price slightly above what you ultimately want to get. That way if you get a low offer, you have some wiggle room to counter and still make your target profit.

Marketing the Property

Great marketing is crucial to maximizing your sales price. Professional photography, enticing listing descriptions, and distribution across multiple platforms like MLS, Zillow, social media are key.

Staging the property is also important. Rent furniture and decor to showcase the home in its best light. Curb appeal matters, so make sure the landscaping is immaculate.

Consider holding open houses or even pre-listing events for agents to generate interest. The more buyers competing, the higher the price you can get.

With the right prep work on pricing and marketing, you can maximize profits on your fixed and flipped property.

Minimizing Risk

When investing in fix-and-flip properties, it’s important to take steps to minimize risk. Here are some key ways to reduce your exposure:

Due Diligence

Conduct thorough due diligence before purchasing a property. Review inspection reports, permits, disclosures etc. Hire professionals to inspect the property and estimate repair costs. Uncover any issues that could dramatically impact the scope or budget of the project.

Contingencies

Structure your purchase offer with contingencies that allow you to back out if undisclosed issues are uncovered. Common contingencies include inspection, financing, appraisal etc. Do not waive contingencies in a hot market. Protect yourself.

Insurance

Get the right insurance coverage for your flip project. This includes general liability, workers comp if you have employees, and property insurance during construction. An umbrella policy provides additional protection. Review coverage with an insurance agent experienced with investors.

Proper due diligence, smart contingencies, and adequate insurance are key to reducing the risks involved with fix-and-flip investing. Take your time, do it right, and don’t let a hot property entice you into compromising your risk management. With the right precautions, fix-and-flip projects can be executed smoothly and profitably.

Finding Tenants

A key part of a successful fix and flip is finding quality tenants once the renovation is complete. The rental income will help cover your costs and generate profit. Effective marketing and property management are critical to attracting and retaining good tenants.

Marketing to Renters

- List the property on rental sites like Zillow, Trulia, HotPads, and Craigslist. Highlight updated features and include attractive photos.

- Create flyers to distribute around the neighborhood. Let locals know about your newly renovated rental.

- Network with people and tell them you have a property available. Word of mouth can be very effective.

- Hold an open house so potential tenants can view the property in-person.

- Highlight amenities like new kitchens, bathrooms, flooring, and appliances that renters want.

- Price the rent competitively based on market rates to attract interest.

Property Management

- Decide whether to manage the property yourself or hire a property management company. Self-managing saves money but requires more time and effort.

- Carefully screen applicant tenants with credit/background checks and in-person interviews.

- Have tenants sign a thorough lease agreement clearly defining rules, rent due dates, fees, etc.

- Conduct regular inspections and maintenance to keep the property in good shape.

- Collect rent on time and address late payments promptly.

- Market and fill vacancies quickly when tenants move out.

- Develop positive relationships with tenants and resolve any issues fairly.

Good marketing and property management will lead to minimal vacancies and consistent rental income.

Is Fix and Flip Right for You?

Fixing and flipping houses can be a profitable endeavor, but it requires a substantial time commitment and access to financing. Before jumping in, make sure you understand what’s involved and consider whether it aligns with your goals, skills, and resources.

Time Commitment

Flipping houses is not a passive investment. You’ll need to devote considerable time to finding promising properties, estimating renovation costs, overseeing contractors, staging the home, and marketing it for resale. Plan on spending at least 10-20 hours per week managing a flip. You’ll also need flexibility to be available for meetings and to address issues that come up during the rehab process.

Financial Requirements

You’ll need access to financing to purchase the property and fund repairs. Many flippers use hard money loans, private money loans, or cash to acquire properties. Repairs often cost 20-30% of the purchase price. And you’ll need holding costs to cover taxes, insurance and interest payments during the flip. Most flips take 4-6 months to complete, so you must have enough working capital to carry the project this long.

Alternatives Like REITs

If you don’t have the time or access to financing for flips, alternatives like real estate investment trusts (REITs) allow you to invest in real estate without being an active owner. REITs own portfolios of properties and sell shares to investors. This provides a more passive approach to earn income through real estate appreciation and rents, without the day-to-day management involved with flips.

Flipping isn’t for everyone. Make sure you fully understand the scope of work and have the time and resources to tackle renovations. If not, REITs can be a suitable alternative way to add real estate to your investment portfolio. For any of your real estate investing needs, we are Home Buyers in Richmond, VA.

Give Us a Call Today at (804) 420-8515