Importance of Staying Informed on Real Estate Market Trends

Staying informed about the latest real estate market trends is crucial for making well-informed decisions, whether you’re a homebuyer, seller, or investor. The real estate market is dynamic, and factors such as interest rates, housing inventory, and economic conditions can significantly impact property values and market conditions.

By keeping up-to-date with market trends, you can better understand the current state of the housing market in your area and make more informed decisions about buying, selling, or investing in real estate. This knowledge can help you identify the right time to enter or exit the market, negotiate better deals, and make strategic investment choices. Expand your real estate investing knowledge: Take Your Real Estate Game to the Next Level in 2024, including Setting Clear Goals, Network with Other Real Estate Investors, Consider Professional Homebuyers, and Develop a Strong Marketing Strategy.

Moreover, understanding market trends can help you anticipate potential changes in property values, rental rates, and other key factors that influence real estate investments. This insight can guide your investment strategies, allowing you to maximize returns and minimize risks. Let us help when you are looking for a “We Buy Houses in Richmond, Virginia“ company.

National and Regional Real Estate Market Trends

Home Prices

Nationally, home prices have continued to rise over the past year, driven by low inventory levels and high buyer demand. However, the pace of price appreciation has begun to moderate in some markets as higher mortgage rates and affordability concerns start to impact buyers’ budgets. Regional variations remain significant, with some areas experiencing double-digit annual price growth, while others have seen more modest increases or even slight declines.

Inventory Levels

The number of homes for sale has been persistently low across most markets, resulting in a competitive environment for buyers. While new listings have picked up in recent months, the supply of available properties remains well below historical norms. This shortage of inventory has been a primary factor fueling the rapid price growth seen in many areas. However, some markets are starting to show signs of inventory relief as more sellers list their homes.

Buyer/Seller Dynamics

The real estate market has favored sellers for the past few years, with multiple offers and bidding wars becoming commonplace in many areas. However, as mortgage rates continue to rise and affordability constraints set in, the balance of power may start to shift toward buyers in some markets. Sellers may need to adjust their pricing expectations, and buyers may gain more negotiating leverage. That said, the extent of this shift will likely vary by location and price point.

How Interest Rates Affect Affordability and Projections on Future Rate Changes

How Interest Rates Affect Affordability

Rising interest rates directly impact housing affordability by increasing the cost of borrowing money for a mortgage. When interest rates rise, the monthly mortgage payment for a given home price increases, making it more expensive for buyers to finance their purchase. This can price some potential buyers out of the market, reducing overall demand.

Additionally, higher interest rates make it more costly to carry higher loan amounts, effectively lowering the maximum home price that buyers can afford for a given monthly payment. As a result, rising rates tend to put downward pressure on home prices by constraining what buyers are willing and able to pay.

Projections on Future Rate Changes

Interest rate projections play a crucial role in shaping real estate market trends and affordability expectations. The Federal Reserve closely monitors economic indicators like inflation, employment, and economic growth to guide its monetary policy decisions, including adjustments to the federal funds rate.

Based on recent statements and actions by the Federal Reserve, most experts anticipate that interest rates will continue to rise gradually over the next 12-18 months as the central bank aims to maintain price stability and manage inflationary pressures. However, the pace and magnitude of these rate hikes remain uncertain and will depend on evolving economic conditions.

Some forecasts suggest that the 30-year fixed mortgage rate, which is heavily influenced by the federal funds rate, could reach 6-7% by the end of 2023 or early 2024. This would represent a significant increase from the current rates, which hover around 5-5.5% as of mid-2023.

It’s important to note that interest rate projections are subject to change and can be influenced by various factors, including global economic conditions, geopolitical events, and shifts in market sentiment. Real estate market participants should closely monitor these projections and their potential impact on affordability and pricing trends.

Unemployment, Inflation, and Consumer Confidence: Impacts on the Housing Market

Unemployment

High unemployment rates can significantly impact the housing market. When unemployment rises, fewer people have stable incomes, making it challenging to afford mortgage payments or qualify for home loans. This reduced demand can lead to a decrease in home prices and a slowdown in real estate activity. Conversely, low unemployment rates often correlate with a stronger housing market, as more people have the financial means to purchase homes.

Inflation

Inflation, or the general increase in prices for goods and services, can also influence the housing market. When inflation is high, the cost of building materials, labor, and other construction expenses rise, making it more expensive to build new homes. Additionally, higher inflation can lead to higher mortgage rates, making home purchases less affordable for many buyers. However, in some cases, real estate can be seen as a hedge against inflation, as property values may appreciate over time.

Consumer Confidence

Consumer confidence plays a crucial role in the housing market. When consumers feel optimistic about the economy and their financial situations, they are more likely to make significant investments, such as purchasing a home. Conversely, low consumer confidence can lead to hesitancy in the housing market, as potential buyers may delay or postpone their home-buying plans. Consumer confidence is influenced by various factors, including employment rates, inflation, and overall economic conditions.

Their Impact on Housing

The interplay of unemployment, inflation, and consumer confidence can have far-reaching effects on the housing market. High unemployment, coupled with high inflation and low consumer confidence, can create a perfect storm, leading to a slowdown in real estate activity, declining home prices, and an overall weaker housing market. Conversely, low unemployment, stable inflation, and high consumer confidence can drive demand for housing, leading to increased home sales, rising prices, and a robust real estate market. Understanding these economic indicators and their impacts is crucial for homebuyers, sellers, and industry professionals to navigate the ever-changing real estate landscape.

New Home Construction and Housing Starts

The housing market is a crucial economic indicator, and new home construction data provides valuable insights into its trajectory. Housing starts, which measure the number of new residential construction projects begun during a given period, offer a glimpse into future supply and demand dynamics.

In recent years, housing starts have experienced fluctuations influenced by factors such as interest rates, labor and material costs, and consumer confidence. Despite challenges posed by the COVID-19 pandemic, the housing market has shown remarkable resilience, driven by low mortgage rates and a desire for more spacious living environments.

One notable trend is the shift in demand from urban to suburban areas. As remote work became more prevalent, many individuals sought larger homes with dedicated office spaces and outdoor amenities. This migration has fueled construction activity in suburban and exurban regions, where land is more readily available and housing costs are generally lower.

However, urban centers continue to attract developers and homebuyers alike, particularly in vibrant job markets and areas with robust public transportation systems. The rise of mixed-use developments, combining residential, commercial, and recreational spaces, has contributed to the revitalization of many city neighborhoods.

Growth areas for new home construction vary across the country, influenced by job opportunities, population shifts, and local economic conditions. Regions with strong technology, healthcare, and energy sectors have witnessed an influx of new residents and a corresponding surge in housing demand.

Monitoring housing starts and new home construction data is crucial for understanding the real estate market’s trajectory and identifying emerging trends. This information can guide investment decisions, urban planning efforts, and policy initiatives aimed at addressing housing affordability and promoting sustainable growth.

Rental Rates and Vacancy Trends

Staying informed about rental rates and vacancy trends is crucial for both property owners and prospective renters or buyers. These metrics provide valuable insights into the state of the real estate market and can influence investment decisions.

Rental Rates

Rental rates are a key indicator of the demand for housing in a particular area. When demand is high and supply is limited, rental rates tend to rise. Conversely, when there is an oversupply of rental units or a decrease in demand, rental rates may decline. Factors that can influence rental rates include:

- Job growth and economic conditions

- Population growth and demographic shifts

- New construction and housing supply

- Interest rates and mortgage availability

- Regulations and rental policies

By monitoring rental rate trends, property owners can adjust their pricing strategies accordingly, while renters can gauge the affordability of different neighborhoods or cities.

Vacancy Rates

Vacancy rates measure the percentage of available rental units that are unoccupied at a given time. Low vacancy rates generally indicate a tight rental market, while high vacancy rates suggest an oversupply of rental units. Vacancy rates can vary significantly between different property types (e.g., apartments, single-family homes) and locations.

Tracking vacancy rates is essential for property owners to minimize prolonged vacancies and maximize occupancy. Low vacancy rates may signal an opportunity to raise rents, while high vacancy rates may necessitate incentives or price adjustments to attract tenants.

For prospective renters, vacancy rates can provide insights into the competitiveness of the rental market and the availability of desirable units.

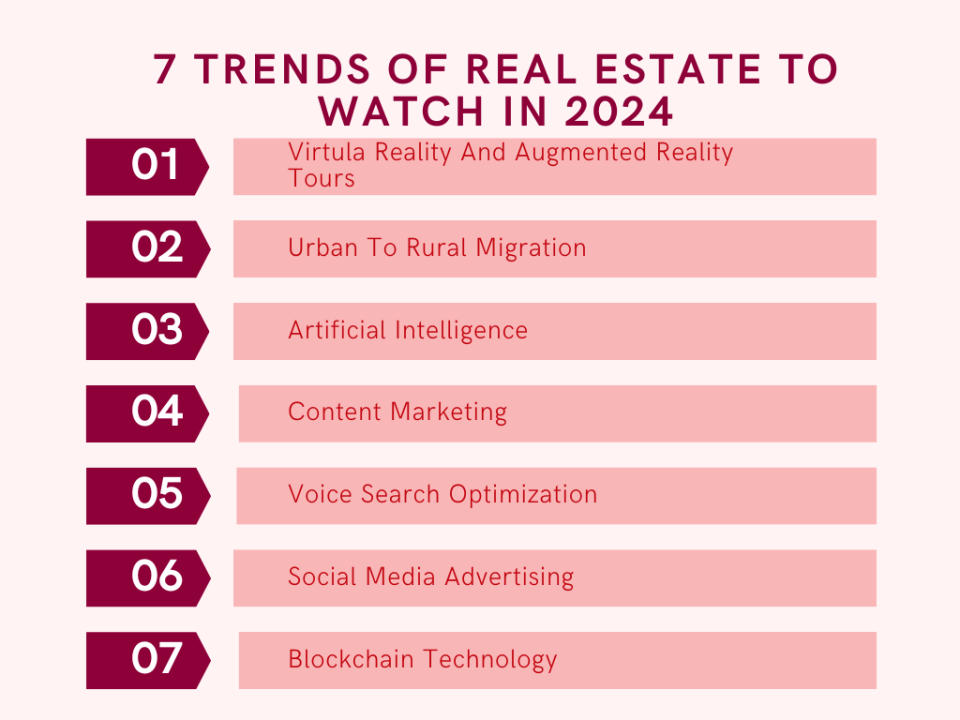

Real Estate Technology and Innovation

The real estate industry is being transformed by cutting-edge technologies, collectively known as PropTech (Property Technology). PropTech encompasses a wide range of digital tools and platforms that streamline various aspects of the real estate process, from property search and virtual tours to data-driven pricing models and transaction management.

One of the most significant PropTech trends is the rise of virtual tours and 3D property visualizations. These immersive digital experiences allow buyers to explore properties from the comfort of their homes, saving time and effort while providing a realistic representation of the space. Virtual tours have become increasingly popular in the wake of the COVID-19 pandemic, enabling safe and contactless property viewings.

Additionally, data-driven pricing models are revolutionizing the way properties are valued and priced. Leveraging sophisticated algorithms and vast data sets, these models analyze numerous factors, such as location, property characteristics, market trends, and comparable sales, to provide accurate and up-to-date pricing recommendations. This data-driven approach helps sellers maximize their returns and buyers make informed decisions.

PropTech is also transforming the way buyers and sellers interact with real estate professionals. Online platforms and mobile apps now facilitate seamless communication, document sharing, and transaction management, streamlining the entire process from initial property search to closing. This increased efficiency and transparency benefit all parties involved, fostering trust and satisfaction.

As PropTech continues to evolve, it is reshaping the real estate landscape, offering convenience, accuracy, and efficiency to buyers, sellers, and industry professionals alike. Embracing these technological advancements is crucial for staying ahead in today’s competitive real estate market.

Millennial, Baby Boomer, and Immigrant Homebuyer Trends

Millennials, the largest generation in the U.S. workforce, are now entering their prime homebuying years. As they delay marriage and having children, many millennials are opting for smaller, more affordable homes in urban areas close to jobs, entertainment, and amenities. However, as they start families, the desire for more space and better school districts is driving some millennials to the suburbs.

Baby boomers, on the other hand, are downsizing and seeking low-maintenance living situations. Many are selling their large suburban homes and moving into urban condos, townhouses, or active adult communities. Others are relocating to warmer climates or areas with lower costs of living.

Immigrant homebuyers are another driving force in the real estate market. As their incomes and credit profiles improve, many are achieving the American dream of homeownership. They often seek properties in ethnic enclaves or areas with good school districts and community resources.

The urban vs. suburban debate rages on, with both markets seeing demand. Walkable cities and revitalized downtowns are attracting young professionals and empty nesters. But the suburbs still hold appeal for families seeking more space, yards, and highly-rated schools. The line is blurring, however, as suburban town centers become more urbanized with mixed-use developments.

Signs of a Cooling or Heating Real Estate Market

Signs of a Cooling Market

A cooling real estate market typically exhibits several telltale signs:

Increase in Housing Inventory: As demand starts to wane, the number of homes listed for sale will rise. Sellers may find it takes longer to attract buyers, leading to a buildup of available properties on the market.

Longer Days on Market: Properties will tend to linger on the market for an extended period before going under contract. The average days on market metric will trend upwards as buyers become more selective and negotiate harder.

Price Reductions: To attract buyers in a softer market, sellers may need to reduce their asking prices. An increase in price cuts and a higher percentage of homes selling below list price can signal a shift towards a buyer’s market.

Declining Sales Volume: Fewer homes will be trading hands as both buyers and sellers adopt a more cautious stance. A noticeable drop in closed sales compared to previous periods can indicate that the market is losing steam.

More Incentives and Concessions: To facilitate transactions, sellers may sweeten the deal by offering incentives like paying for closing costs, making repairs, or including appliances and furniture in the sale.

Signs of a Heating Market

Conversely, a heating real estate market tends to display opposite trends:

Limited Housing Supply: High demand coupled with a scarcity of listings leads to a depleted inventory of available homes for sale. Buyers face stiff competition and limited choices.

Rapid Sale Times: Desirable properties move quickly, often receiving multiple offers within days or even hours of being listed. The average days on market will compress as buyers race to snap up listings.

Rising Prices: Basic economic principles of supply and demand come into play, with prices climbing as buyers bid up the cost of the limited inventory of homes.

Increased Sales Activity: More transactions are closing each month as both buyers and sellers capitalize on the favorable conditions. Sales volume and pending contracts will be on an upward trajectory.

Fewer Incentives and Contingencies: In a red-hot seller’s market, buyers may need to waive contingencies and forego asking for concessions to make their offers more competitive and appealing.

Monitoring these vital signs can provide valuable insights into the current state and trajectory of the local real estate market. Staying attuned to these indicators allows buyers, sellers, and industry professionals to make informed decisions and strategize accordingly.

Leveraging Government, Industry, and Academic Data Providers

To stay truly up-to-date on real estate market trends, it’s crucial to consult authoritative data sources from government agencies, industry associations, and academic institutions. These entities conduct extensive research and analysis, providing valuable insights into market dynamics, pricing trends, demographic shifts, and regulatory changes that shape the real estate landscape.

Government agencies like the U.S. Census Bureau, Department of Housing and Urban Development (HUD), and Bureau of Labor Statistics offer a wealth of data on housing market conditions, homeownership rates, construction activity, and employment trends that influence real estate demand. Industry groups such as the National Association of Realtors (NAR), Urban Land Institute (ULI), and Mortgage Bankers Association (MBA) conduct regular surveys and publish reports on sales volumes, home prices, rental rates, and mortgage origination trends.

Academic institutions, including universities and research centers, often collaborate with government and industry partners to analyze real estate market data from a more objective and scholarly perspective. Their studies delve into topics like housing affordability, gentrification, and the impact of economic factors on real estate markets, offering valuable context and nuanced analysis.

By regularly consulting these authoritative data sources, real estate professionals can gain a comprehensive understanding of market trends, identify emerging opportunities and challenges, and make informed decisions regarding property investments, development projects, and marketing strategies. Let us help when you are thinking to “Cash for My House in Richmond, Virginia“.

Call Today at (804) 420-8515