Introduction

If you’re inheriting a home from a loved one, you’ll likely have some questions about what comes next. It can be a great thing, but you need to be aware of the potential hidden costs. Tax Obligations When Inheriting a House and potential Mediation Expenses for Inherited Real Estate are often unexpected. Another area is that utilities and maintenance costs are often higher than expected and can catch people by surprise. Vacant properties often have hidden problems that you don’t want to deal with. You’ll also need cash upfront for renovations or repairs. Selling for cash can eliminate risk and solve problems! Are you aware of the 4 Hidden Costs You Can Face When Inheriting a Property in Richmond, VA?

Utilities bill can add up

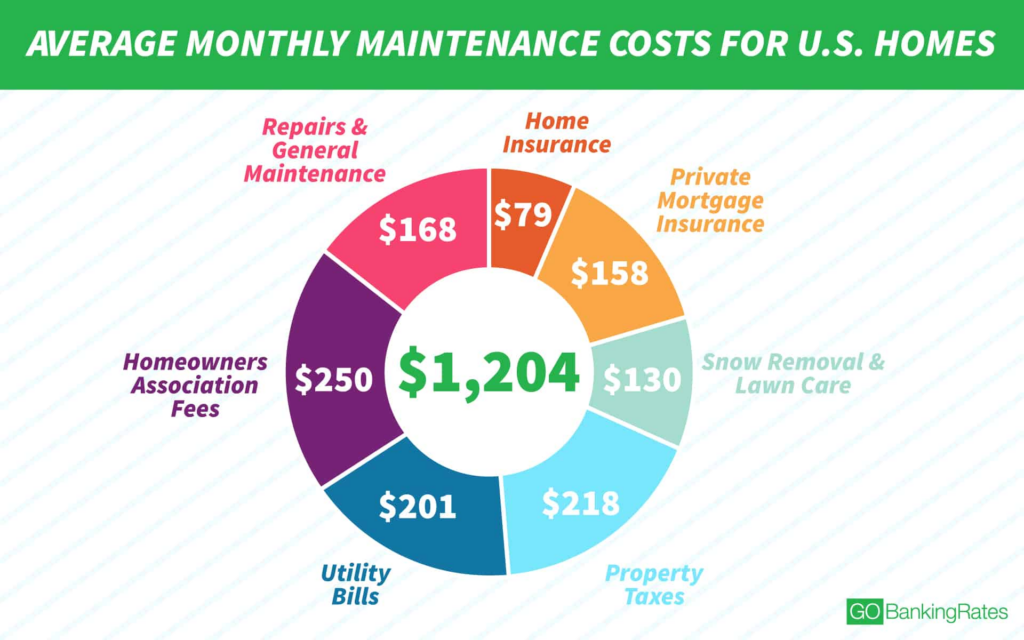

One of the first things you need to do is make sure all the utilities are on in the house. Not doing so could be very costly particular during times of inclement weather. You need to pay to keep the lights on, need the water, electricity, gas, and other utilities too. Also, there may be some outstanding utility bills that need paying. These costs can add up quickly. If you’re a new homeowner or a new homeowner in the town/city, you will also have to consider whether utility security deposits will be required for each of the different services.

Maintenance costs can high

Inherited properties often come with high maintenance costs. It’s important to understand the cost of maintaining an inherited property before buying it, as these costs can be more than you expect. When you inherit a home from a loved one, you may be surprised by how much money you need to spend on repairs and maintenance over time. The value of your inheritance could decrease if they have lived in the house for many years without keeping the house up to date. This means that any money spent on repairs would not go towards increasing the value of your inheritance but rather maintaining its current condition.

Vacant properties often have hidden problems

When you inherit a property, it can be difficult to tell what condition it’s in. If there are no tenants living on the premises and no one has been maintaining the place for some time, then there are likely to be many problems that were not visible before. For example:

Vandalism and crime tend to increase around vacant properties because they provide easy access for criminals looking for an empty place where they won’t be seen or disturbed. If your inherited house has been vacant for some time, then chances are good that it has suffered some damage in this way; if not already vandalized before you purchased it (which often happens), then certainly after purchase due to curious passersby who want to see what’s inside but don’t have permission.

You’ll need cash upfront

You will need cash upfront to buy the property. If there is any work that needs doing before you can sell or move into it, or any unexpected repairs after taking possession of the house, then you’ll need some money saved up for this purpose.

You will also need cash upfront when refinancing inherited properties because lenders will want proof that all debts have been cleared before they lend you more than 80% of your new purchase price (if they do). This could mean paying off mortgages and personal loans on other properties owned by family members too – so make sure they’re aware beforehand!

Borrowing money to buy an inherited property can be risky. You may not be able to afford the payments and other associated costs, which could lead you into financial trouble. The lender may also look closely at how much equity is present before making any final decision about whether or not lending would be appropriate under the current circumstances.

Selling for Cash can eliminate risk and solve problems

Sell for cash to an experienced and local real estate investor. If you’re looking to get out of your inherited property, selling for cash can eliminate risk and solve problems. Selling an inherited property for cash can help you move on with your life.

Find a local investor

- Find a local investor with experience in the area.

- Find a local investor with experience in the property type.

- Find a local investor with experience in the property condition.

- Find a local investor with experience in the property price range and age of home you are looking at buying, if applicable (some investors only buy new construction).

Conclusion

We hope that this article has given you some insight into what it’s like to be an inherited property owner. We know that these types of homes can be a great opportunity, but they can also be tricky if you don’t know what to expect. If you decide to sell for cash, RVA Home Buyers is an experienced, local real estate investor that specializes in inherited properties.

Give Us a Call Today at (804) 420-8515