Introduction

Owner financing, also known as seller financing or vendor financing, is a type of real estate transaction where the current property owner provides financing to the buyer instead of the buyer obtaining a traditional mortgage from a bank or lender. In this arrangement, the seller essentially acts as the lender, and the buyer makes payments directly to the seller over an agreed-upon period until the property is fully paid off. We can help when you’re thinking to “Sell My House Fast in Richmond, Virginia“.

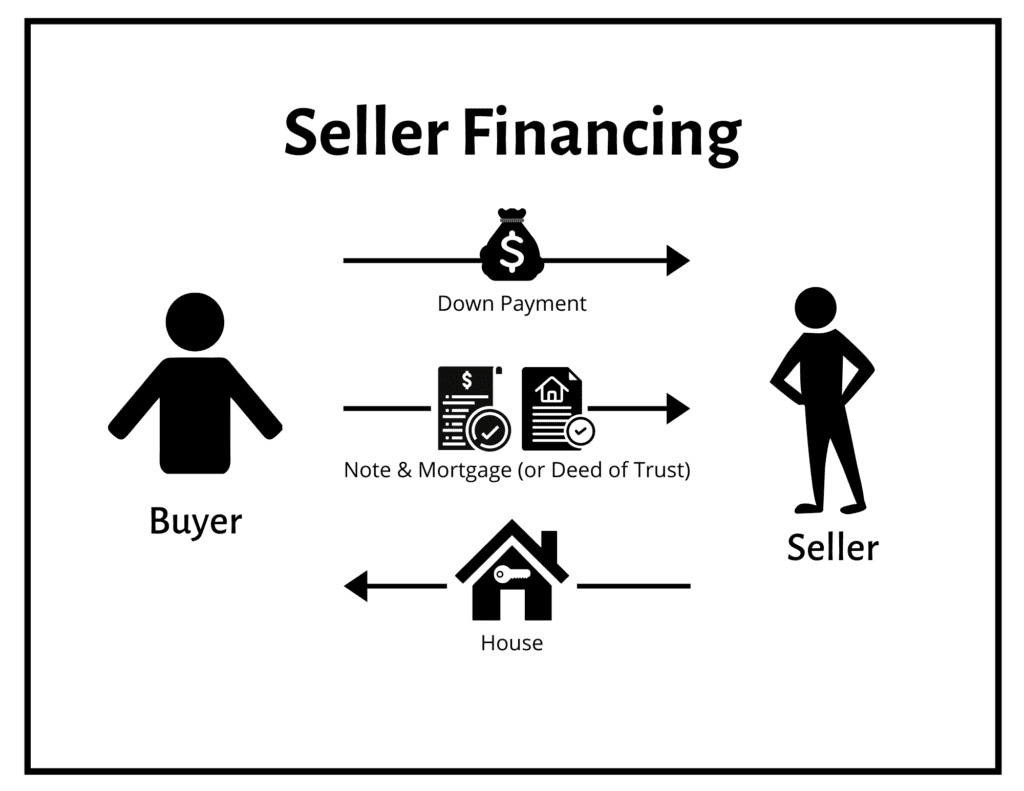

Owner financing differs from traditional mortgages in several ways. Firstly, the property owner, not a financial institution, is responsible for setting the terms of the financing agreement, including the interest rate, down payment, and repayment schedule. Secondly, the transaction is typically less regulated and may have more flexible qualification requirements compared to traditional mortgages. Finally, the property ownership is transferred to the buyer at the time of purchase, with the seller retaining a lien on the property until the loan is fully repaid. Make sure you are well educated before leveraging these valuable strategies: 5 Things to Know About Investing In Richmond Real Estate By Using Owner Financing, including How Does Owner Financing Work, Benefits of Owner Financing for Real Estate Investors, RVA Home Buyers Helps Investors Find Deals With Owner Financing, and What Should Investors Consider Before Using Owner Financing?

How Owner Financing Works

Owner financing, also known as seller financing or a rent-to-own agreement, is a process where the current owner of a property acts as the lender and provides financing directly to the buyer. Instead of obtaining a mortgage from a bank or traditional lender, the buyer makes payments to the seller over an agreed-upon period of time until the property is fully paid off.

The process typically involves the following steps:

- Negotiation: The buyer and seller negotiate the terms of the financing agreement, including the purchase price, interest rate, down payment amount, and repayment schedule.

- Contract Creation: A legally binding contract is drafted, outlining the terms of the agreement and the responsibilities of both parties. This contract may include provisions for late payments, defaults, and other contingencies.

- Down Payment: The buyer typically provides a down payment, which can range from a small percentage to a significant portion of the purchase price, depending on the agreement.

- Ownership Transfer: The seller transfers ownership of the property to the buyer, either through a deed or a land contract. However, the seller retains the legal right to the property until the buyer has made all payments.

- Repayment: The buyer makes regular payments to the seller according to the agreed-upon schedule, which may include interest charges. These payments are typically structured like a traditional mortgage, with a portion going towards the principal and a portion covering interest.

- Final Payment: Once the buyer has made all required payments, the seller transfers full ownership of the property to the buyer through a warranty deed or other legal documentation.

It’s important to note that the legal requirements and processes for owner financing can vary depending on the state or jurisdiction. Both parties should carefully review and understand their roles, responsibilities, and the potential risks involved in the transaction.

Advantages of Owner Financing

For Buyers:

- Easier to qualify for financing, especially with poor credit or limited income

- Avoid stringent lending requirements from banks and mortgage companies

- More flexible down payment and loan terms can be negotiated

- Quicker closing process with less paperwork and bureaucracy

- Build credit history through timely payments to the seller

For Sellers:

- Attract a wider pool of potential buyers who may struggle with traditional financing

- Earn interest income on the loan instead of a lump sum sale price

- Sell the property faster by making it accessible to more buyers

- Retain some control over the property until the loan is fully paid

- Potential for a higher overall sale price with interest charges

- Tax benefits by spreading out income over multiple years

Owner financing offers unique advantages for both buyers and sellers in a real estate transaction. It provides flexibility, accessibility, and potential financial benefits when utilized effectively.

Disadvantages and Risks

Owner financing can be a convenient alternative to traditional mortgages, but it also carries several risks and potential downsides for both buyers and sellers:

For Buyers:

- Higher Interest Rates: Owner-financed properties often come with higher interest rates than those offered by banks or mortgage lenders, making the overall cost of the purchase more expensive in the long run.

- Lack of Consumer Protections: Traditional mortgages are regulated and come with consumer protections, such as the Truth in Lending Act and the Real Estate Settlement Procedures Act. Owner financing agreements may not provide the same level of protection for buyers.

- Risk of Foreclosure: If the buyer defaults on their payments, the seller can initiate foreclosure proceedings, potentially leading to the loss of the property and any equity built up.

- Limited Financing Options: Owner financing may limit the buyer’s ability to refinance or take out additional loans against the property in the future.

For Sellers:

- Default Risk: If the buyer fails to make payments, the seller may have to go through a costly and time-consuming legal process to regain possession of the property.

- Responsibility for Repairs and Maintenance: In some owner financing agreements, the seller may be responsible for repairs and maintenance of the property until the buyer has fully paid off the loan.

- Tax Implications: Sellers may be required to pay taxes on the interest income received from the buyer’s payments, which can be a complex process.

- Difficulty Selling the Note: If the seller needs to sell the promissory note (the legal agreement for the loan) to another party, it can be challenging to find a buyer and may result in a discounted sale price.

Both buyers and sellers should carefully consider the potential risks and seek legal advice before entering into an owner financing agreement to ensure their interests are protected and they fully understand the terms and conditions.

Owner Financing vs. Traditional Mortgages

Owner financing differs from traditional mortgages in several key ways. One major difference is interest rates. With owner financing, the seller sets the interest rate, which can be higher or lower than current market rates for traditional mortgages. This allows for more flexibility but also potential risk for both parties.

Another key distinction is the down payment requirement. Traditional mortgages often require a substantial down payment, usually 20% or more of the home’s value. With owner financing, the seller can decide on the down payment amount, which may be lower or even zero in some cases. This can make owner financing more accessible for buyers with limited cash on hand.

Credit requirements also vary significantly between owner financing and traditional mortgages. When working with a bank or mortgage lender, buyers typically need to meet strict credit score and income requirements to qualify. With owner financing, the seller can choose to be more lenient with credit qualifications or even waive them entirely, depending on their comfort level and the specific agreement.

Overall, owner financing offers more flexibility but also increased risk compared to traditional mortgages. The lack of standardized requirements means both parties must carefully evaluate the terms and potential consequences before entering into an owner financing agreement.

Legal Requirements and Contracts

Owner financing transactions require careful documentation and legally binding contracts to protect both the buyer and seller. While the specific requirements may vary by state, there are several key elements that should be included in an owner financing agreement.

First and foremost, a promissory note should be drafted to outline the loan terms, including the principal amount, interest rate, payment schedule, and any penalties for late or missed payments. This document serves as legal evidence of the debt owed by the buyer to the seller.

The contract should also include a deed of trust or mortgage, which secures the loan with the property itself. This document gives the seller (lender) the right to foreclose on the property if the buyer (borrower) defaults on the loan. It’s essential to properly record this document with the county to establish the seller’s legal claim on the property.

Other important terms to consider in the contract include:

- Due-on-sale clause: This clause prevents the buyer from transferring the property without paying off the remaining loan balance.

- Acceleration clause: Allows the seller to demand full repayment of the loan if the buyer violates specific terms of the agreement.

- Insurance requirements: The contract should specify that the buyer must maintain adequate insurance coverage on the property.

- Maintenance and repair responsibilities: Clearly outline who is responsible for maintaining the property and making necessary repairs.

It’s crucial to consult with a qualified real estate attorney to ensure that the contract complies with all relevant state laws and regulations. Some states have specific requirements for owner financing agreements, such as maximum interest rates, disclosure statements, or cooling-off periods.

Proper documentation and a well-drafted contract are essential for protecting both parties’ interests and ensuring a smooth owner financing transaction.

Qualifying for Owner Financing

Qualifying for owner financing involves meeting certain criteria set by the seller, as there are no standardized requirements like those for traditional mortgages. From the buyer’s perspective, the seller will likely evaluate factors such as credit score, income, employment history, and overall financial responsibility. While specific credit score minimums can vary, most sellers prefer buyers with scores in the mid-600s or higher to demonstrate a strong history of making payments on time.

Income verification is also important, as the seller wants assurance that the buyer can comfortably afford the monthly payments. Buyers may need to provide documentation like pay stubs, tax returns, and bank statements to prove their income stability and cash flow. Self-employed buyers may face additional scrutiny in verifying their earnings.

From the seller’s side, their ability to offer owner financing depends on factors like the remaining mortgage balance, equity in the property, and cash reserves for potentially carrying two mortgages temporarily. Sellers with significant equity positioned are better suited to facilitate an owner-financed deal. Additionally, sellers should ensure they comply with any state-specific regulations regarding owner financing arrangements.

Overall, open communication and full transparency between buyer and seller are crucial for setting mutually agreeable terms and qualifying for an owner financing agreement that works for both parties’ financial situations.

Tax Implications

Owner financing has several important tax implications that both buyers and sellers need to be aware of. For the seller, any interest received from the buyer is considered taxable income and must be reported to the IRS. However, the portion of the payments that represents the return of the seller’s initial investment (the property’s cost basis) is not taxable.

Sellers may be able to take deductions for certain expenses related to owner financing, such as legal fees, advertising costs, and loan origination fees. It’s essential to keep detailed records and consult with a tax professional to ensure compliance with all relevant tax laws and regulations.

For buyers, the interest portion of their payments to the seller may be tax-deductible, similar to mortgage interest. However, there are specific requirements and limitations to claim this deduction, such as the property being used as the buyer’s primary residence or for investment purposes.

Buyers should also be aware that any forgiven or canceled debt from the seller may be considered taxable income, depending on the circumstances. This could occur if the seller agrees to accept a lower payoff amount or if the property is eventually foreclosed.

Both parties should consult with tax professionals to understand the specific tax implications of their owner financing arrangement and ensure they are properly reporting and paying taxes on any income or claiming eligible deductions.

Owner Financing for Investors

Owner financing can be an attractive option for real estate investors looking to acquire properties without going through traditional lenders. By working directly with property owners, investors can negotiate terms that may be more favorable than those offered by banks or mortgage companies. This can include lower down payments, more flexible credit requirements, and potentially lower interest rates.

One common strategy for investors is to seek out properties where the owner has a significant amount of equity and is willing to carry the financing. This can be particularly useful for distressed properties or those that may not qualify for traditional financing due to condition or location. The investor can then renovate and either hold the property as a rental or resell it for a profit.

Another use of owner financing for investors is in the realm of lease options or rent-to-own agreements. In these scenarios, the investor essentially rents the property from the owner with a portion of the rent going towards an eventual purchase. This can be a way for investors to control properties with minimal upfront capital while building equity over time.

Investors may also seek out sellers who are motivated to move a property quickly, such as those facing foreclosure or relocation. By offering owner financing, the investor can provide a solution that allows the seller to avoid the negative consequences of a foreclosure while still receiving periodic payments.

Overall, owner financing can provide investors with increased flexibility and potential for higher returns, but it also comes with additional risks and legal considerations. Investors should carefully evaluate each opportunity and ensure that all agreements are properly documented and comply with relevant laws and regulations.

When Owner Financing Makes Sense

Owner financing can be an attractive option in various scenarios where traditional financing may be challenging or less favorable. Here are some situations where owner financing may make sense:

For Buyers with Less-Than-Perfect Credit: Individuals with poor credit scores or a history of financial challenges may find it difficult to qualify for a conventional mortgage. Owner financing can provide an alternative path to homeownership without the stringent credit requirements of traditional lenders.

For Properties That Don’t Meet Conventional Lending Standards: Some properties, such as fixer-uppers, unique or unconventional homes, or properties in remote areas, may not meet the criteria for traditional mortgages. Owner financing can offer a solution for purchasing these types of properties.

For Buyers Seeking Faster Closing: The process of obtaining a traditional mortgage can be time-consuming, involving extensive paperwork, appraisals, and underwriting. Owner financing can streamline the process, allowing for a faster closing and quicker possession of the property.

For Sellers Seeking a Steady Income Stream: Owners who are willing to finance the sale of their property can benefit from a steady stream of income from the buyer’s payments, potentially earning more in interest over time than they would from a lump-sum cash sale.

For Investors and House Flippers: Real estate investors and house flippers may find owner financing advantageous when acquiring properties that require significant renovations or repairs. It can provide the flexibility to purchase the property, complete the necessary work, and then either refinance or resell the property.

In Tight Housing Markets: In areas with a limited supply of homes and high demand, owner financing can give buyers an edge by offering an alternative financing option, potentially increasing their chances of securing a property.

While owner financing can be beneficial in certain circumstances, it’s crucial for both buyers and sellers to carefully evaluate the risks, legal requirements, and financial implications before entering into such an arrangement.

Finding Owner Financing Opportunities

Locating properties being offered with owner financing can take some diligent effort, as these opportunities are not always widely advertised. However, there are several strategies you can employ to increase your chances of finding potential deals:

Networking and Word-of-Mouth: Attend local real estate investor meetings and connect with other investors who may have come across owner financing opportunities. Building relationships with real estate agents, mortgage brokers, and other professionals in the industry can also help you stay informed about potential leads.

Online Listings and Classifieds: While not as common, some sellers may list their owner financing properties on popular real estate websites or online classifieds. Use specific search filters or keywords like “owner financing” or “seller financing” to narrow down your search.

Direct Mail Campaigns: Consider sending out direct mail campaigns to targeted neighborhoods or areas where you’re interested in purchasing a property. Your letter can express your interest in owner financing opportunities and provide your contact information for potential sellers to reach out.

Driving for Dollars: Physically driving through neighborhoods and keeping an eye out for “For Sale by Owner” signs can sometimes uncover owner financing opportunities. Sellers who are motivated to sell their property may be more open to considering owner financing arrangements.

Public Records Search: Conduct a search of public records, such as property tax records or county recorder’s offices, to identify properties that have been owned for an extended period. Long-term owners may be more open to owner financing as they have built up significant equity.

Networking with Professionals: Build relationships with real estate attorneys, title companies, and other professionals who may come across owner financing situations through their work. They can keep you informed about potential opportunities that align with your investment criteria.

Remember, when pursuing owner financing opportunities, it’s essential to thoroughly vet the property, the seller’s financial situation, and the terms of the agreement. Working with a qualified real estate attorney can help ensure that the transaction is structured properly and that your interests are protected.

Owner Financing Resources

When exploring owner financing options, there are several valuable resources available to help you navigate the process effectively. Here are some key resources to consider:

Books:

Several comprehensive books offer in-depth guidance on owner financing, covering topics such as structuring deals, legal considerations, and best practices. Some popular titles include “The Insider’s Guide to Owner Financing” by Wendy Patton and “The Owner-Financing Handbook” by David Galle.

Websites and Online Communities:

Various websites and online communities provide a wealth of information, tools, and forums dedicated to owner financing. These platforms allow you to connect with experienced professionals, access educational materials, and stay updated on the latest trends and regulations. Some notable websites include OwnersFinancing.com, OwnerFinancing.net, and the BiggerPockets Owner Financing forum.

Real Estate Professionals:

Consulting with experienced real estate professionals can be invaluable when navigating the complexities of owner financing. Real estate attorneys, title companies, and specialized owner financing consultants can offer tailored guidance, assist with drafting contracts, and ensure compliance with local laws and regulations.

Local Investment Clubs and Networking Groups:

Joining local real estate investment clubs or networking groups can provide opportunities to connect with seasoned investors who have experience with owner financing. These groups often host educational events, workshops, and discussions where you can learn from others’ successes and challenges.

Government Resources:

Depending on your location, various government agencies and resources may offer guidance or information related to owner financing. For example, the U.S. Department of Housing and Urban Development (HUD) and state-level housing authorities may provide resources or guidelines specific to your area.

By leveraging these resources, you can gain a comprehensive understanding of owner financing, stay informed about best practices, and increase your chances of navigating the process successfully. We are the “We Buy Houses in Richmond, Virginia” company that can help sellers get creative in selling!

Call Today at (804) 420-8515